Self Employment Loan Options

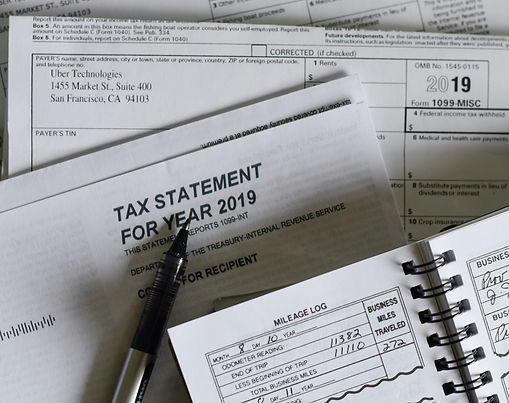

1099 Loan

The 1099 mortgage option from Grace Modern Mortgage is designed for independent contractors and self-employed individuals, utilizing their 1099 tax forms to assess income and determine eligibility for a home loan

Asset Depletion Loan

The Asset Depletion mortgage option allows borrowers to leverage their existing assets, such as stocks or retirement accounts, as a source of income for loan qualification, ideal for retirees or high-net-worth individuals.

Bank Statement Loan

The Bank Statement mortgage option evaluates a borrower's financial health by assessing their bank statements, rather than relying on traditional income documentation, to determine loan eligibility.

Investment Loans

The Non-Income Verification (DSCR) option is designed for real estate investors, using the Debt Service Coverage Ratio (DSCR) to determine loan eligibility, which evaluates the rental income potential of a property relative to the loan payments.

Non Income Verification

The Non-Income Verification (Community) Primary Residence option from Grace Modern Mortgage offers home loans for primary residences without requiring traditional income documentation, focusing on community investment and financial inclusion.

Profit & Loss

The Profit & Loss mortgage option allows borrowers to use a Profit and Loss statement to show income, ideal for business owners and self-employed individuals without traditional income documentation.